Aicpa Cpe Courses

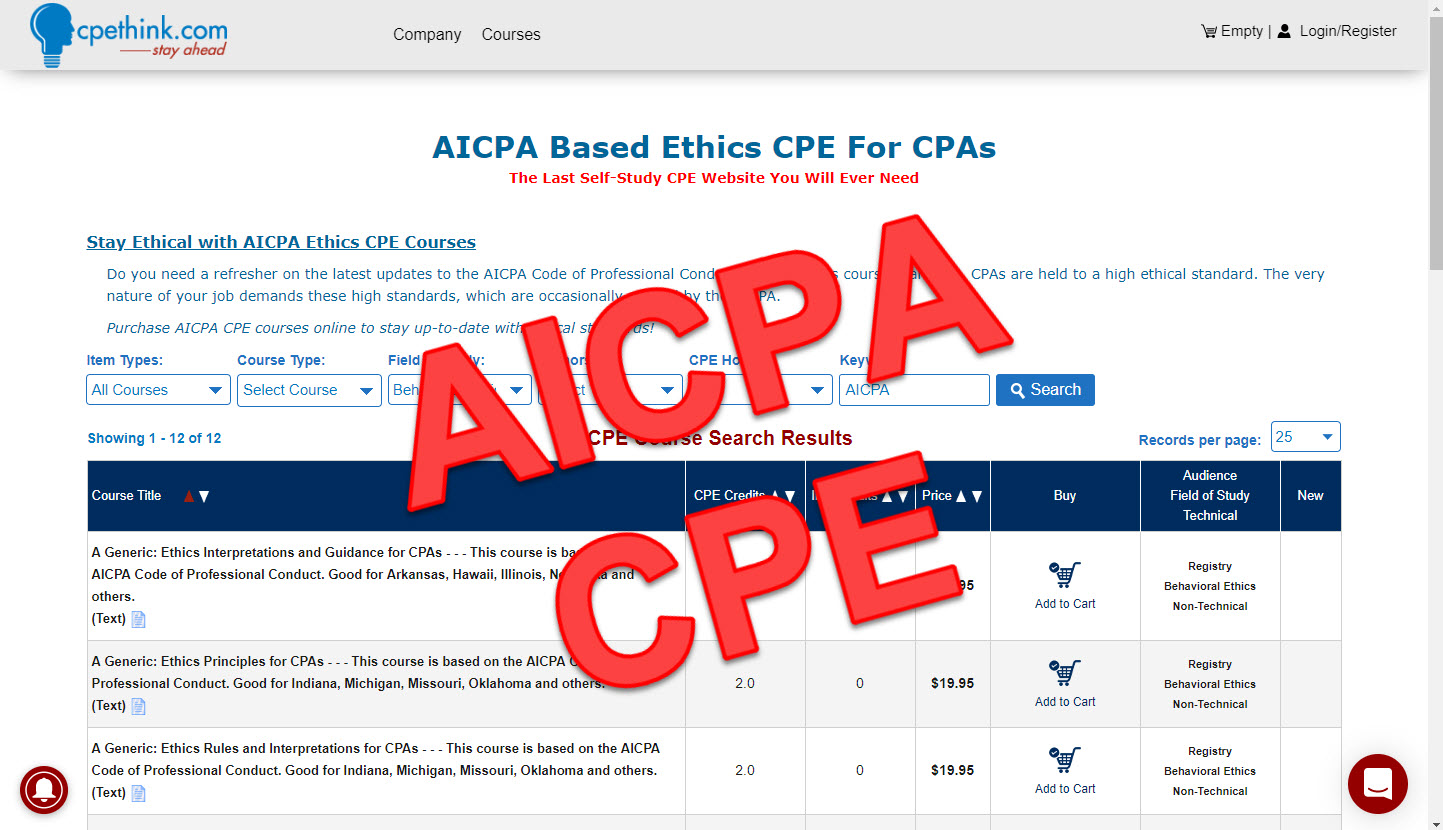

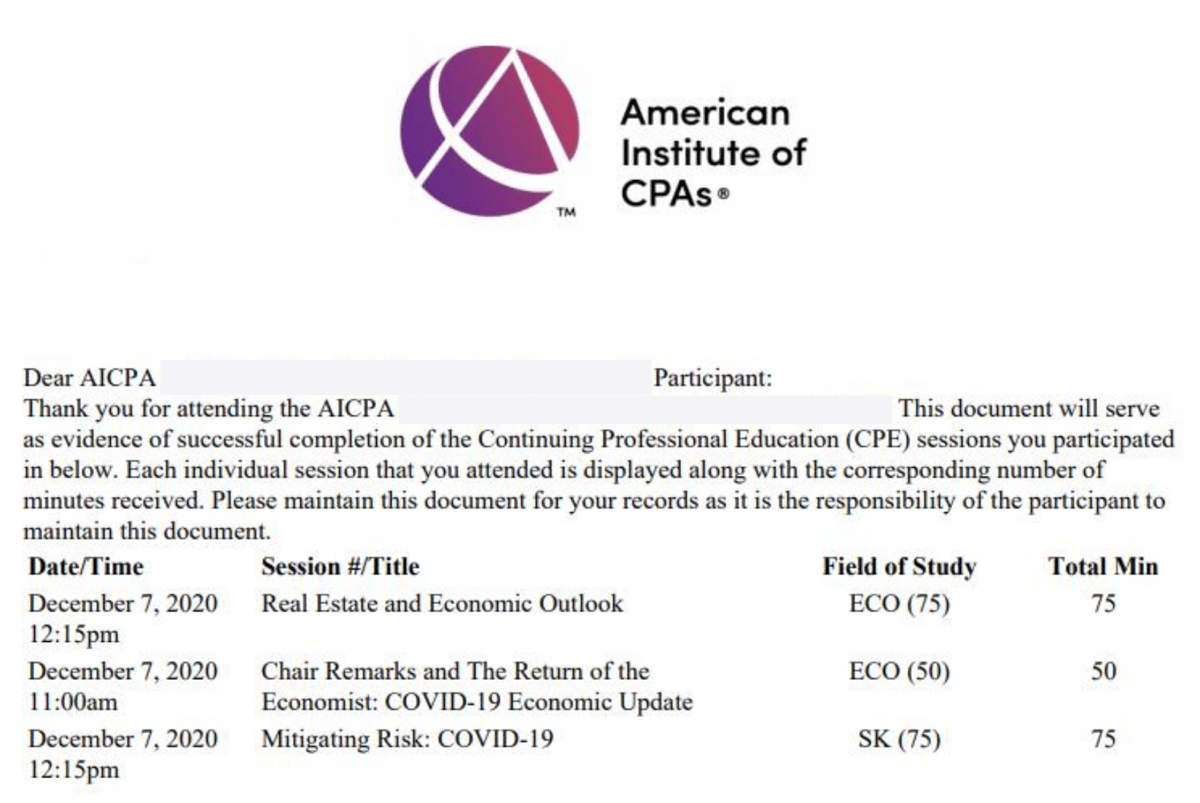

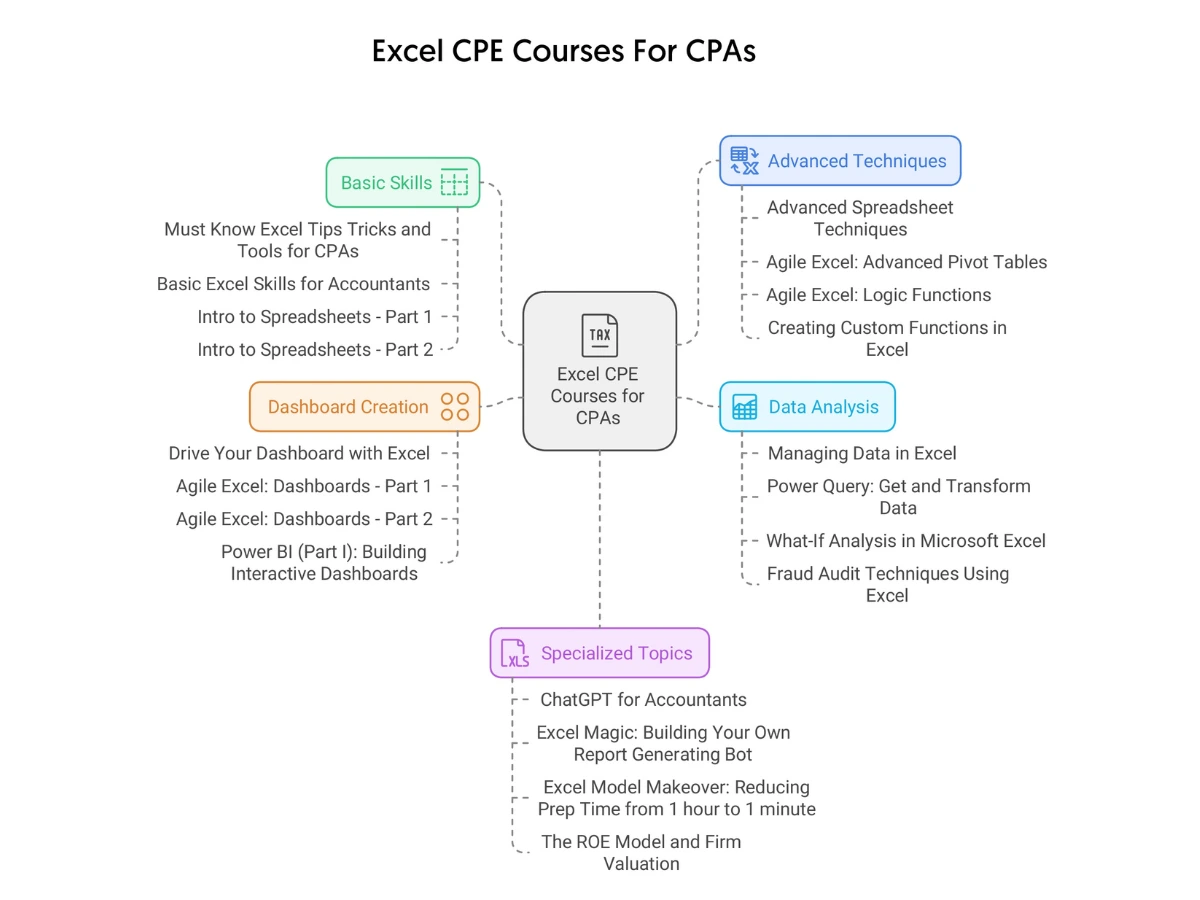

Aicpa Cpe Courses - The entire code of professional conduct is covered in the course and case studies are used to reinforce concepts. All self study courses on the cpe depot site meet the requirements for interactive self study defined by the. As per the aicpa, cpas are required to complete 120 cpe credits every three years, which basically breaks down to 40 per year. At the aicpa store you'll find more than 300 titles in a variety of formats to best meet your needs. Get your illinois cpa continuing education courses online at cpe think. They also offer three free courses, each worth a. Learn about the aicpa code of professional conduct, the ethical standards addressed by the international ethics standards board for accountants, and irs circular 230. Recognize threats to compliance with the code of. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits Explore aicpa & cima's comprehensive courses to enhance your accounting and finance skills. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits However, it is important to recognize that each state. You can find aicpa’s courses here. Cpexpress gives you unlimited online access to quality cpe courses from aicpa subject matter experts on essential topics including tax, accounting, assurance, ethics, employee benefits. The entire code of professional conduct is covered in the course and case studies are used to reinforce concepts. Earn cpe creditsbrowse by cpe100% onlineprofessional development Discover the best learning products tailored for professionals. Earn cpe creditsclear & concise coursestimely & relevant topics As per the aicpa, cpas are required to complete 120 cpe credits every three years, which basically breaks down to 40 per year. Learn about the aicpa code of professional conduct, the ethical standards addressed by the international ethics standards board for accountants, and irs circular 230. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits At the aicpa store you'll find more than 300 titles in a variety of formats to best meet your needs. Discover the best learning products tailored for professionals. Browse our courses, purchase a course and start earning cpe credits immediately. As per the aicpa, cpas are required to complete. Learn about the aicpa code of professional conduct, the ethical standards addressed by the international ethics standards board for accountants, and irs circular 230. Browse our courses, purchase a course and start earning cpe credits immediately. Earn cpe creditsbrowse by cpe100% onlineprofessional development All self study courses on the cpe depot site meet the requirements for interactive self study defined. You can find aicpa’s courses here. Learn about the aicpa code of professional conduct, the ethical standards addressed by the international ethics standards board for accountants, and irs circular 230. Earn cpe creditsbrowse by cpe100% onlineprofessional development The entire code of professional conduct is covered in the course and case studies are used to reinforce concepts. Discover the best learning. Discover the best learning products tailored for professionals. All self study courses on the cpe depot site meet the requirements for interactive self study defined by the. Learn about the aicpa code of professional conduct, the ethical standards addressed by the international ethics standards board for accountants, and irs circular 230. Explore aicpa & cima's comprehensive courses to enhance your. They also offer three free courses, each worth a. You can find aicpa’s courses here. At the aicpa store you'll find more than 300 titles in a variety of formats to best meet your needs. Examples include oversight of corporate culture and. The american institute of certified public accountants' comprehensive course (for licensure) Explore aicpa & cima's comprehensive courses to enhance your accounting and finance skills. Browse our courses, purchase a course and start earning cpe credits immediately. Cpexpress gives you unlimited online access to quality cpe courses from aicpa subject matter experts on essential topics including tax, accounting, assurance, ethics, employee benefits. Examples include oversight of corporate culture and. The american institute. 24/7 customer serviceaccepted in all 50 statestry our courses risk free Earn cpe creditsclear & concise coursestimely & relevant topics Get unlimited online access to hundreds of quality cpe courses from aicpa subject matter experts on essential topics including tax, accounting, assurance, ethics, employee benefits. You can find aicpa’s courses here. However, it is important to recognize that each state. Get your illinois cpa continuing education courses online at cpe think. At the aicpa store you'll find more than 300 titles in a variety of formats to best meet your needs. 24/7 customer serviceaccepted in all 50 statestry our courses risk free However, it is important to recognize that each state. Discover the best learning products tailored for professionals. Earn cpe creditsbrowse by cpe100% onlineprofessional development 24/7 customer serviceaccepted in all 50 statestry our courses risk free Get unlimited online access to hundreds of quality cpe courses from aicpa subject matter experts on essential topics including tax, accounting, assurance, ethics, employee benefits. All self study courses on the cpe depot site meet the requirements for interactive self study defined. Browse our courses, purchase a course and start earning cpe credits immediately. The entire code of professional conduct is covered in the course and case studies are used to reinforce concepts. Discover strategies for selecting cpe courses that enhance cpa skills, support career growth, and fit seamlessly into your professional life. All self study courses on the cpe depot site. Explore aicpa & cima's comprehensive courses to enhance your accounting and finance skills. Earn cpe creditsbrowse by cpe100% onlineprofessional development You can find aicpa’s courses here. Learn about the aicpa code of professional conduct, the ethical standards addressed by the international ethics standards board for accountants, and irs circular 230. The entire code of professional conduct is covered in the course and case studies are used to reinforce concepts. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits They also offer three free courses, each worth a. All self study courses on the cpe depot site meet the requirements for interactive self study defined by the. At the aicpa store you'll find more than 300 titles in a variety of formats to best meet your needs. Discover the best learning products tailored for professionals. Get your illinois cpa continuing education courses online at cpe think. Earn cpe creditsbrowse by cpe100% onlineprofessional development Cpexpress gives you unlimited online access to quality cpe courses from aicpa subject matter experts on essential topics including tax, accounting, assurance, ethics, employee benefits. Examples include oversight of corporate culture and. The american institute of certified public accountants' comprehensive course (for licensure) However, it is important to recognize that each state.CPE Credits The Digital Shift Masterclass Series

PPT AICPA Program_ A Confidence Booster for CPA Aspirants PowerPoint

Online CPE Excel Training Courses AICPA Excel Training

AICPA CPE Requirements and Courses Cpa exam motivation

CPE Credits The Digital Shift Masterclass Series

Learn about digital assets accounting with CPE Credits AICPA posted

Understanding AICPA Code of Conduct Course MYCPE

AICPA Ethics 3 hr Online CPE Course • JN CPE Courses

What is AICPA? CPE Courses & Requirements

What Is CPE For Members Of AICPA? VTR Learning

Discover Strategies For Selecting Cpe Courses That Enhance Cpa Skills, Support Career Growth, And Fit Seamlessly Into Your Professional Life.

24/7 Customer Serviceaccepted In All 50 Statestry Our Courses Risk Free

Browse Our Courses, Purchase A Course And Start Earning Cpe Credits Immediately.

Get Unlimited Online Access To Hundreds Of Quality Cpe Courses From Aicpa Subject Matter Experts On Essential Topics Including Tax, Accounting, Assurance, Ethics, Employee Benefits.

Related Post:

-(2)-1701701195.webp)