Credit Counseling Course Online For Chapter 13

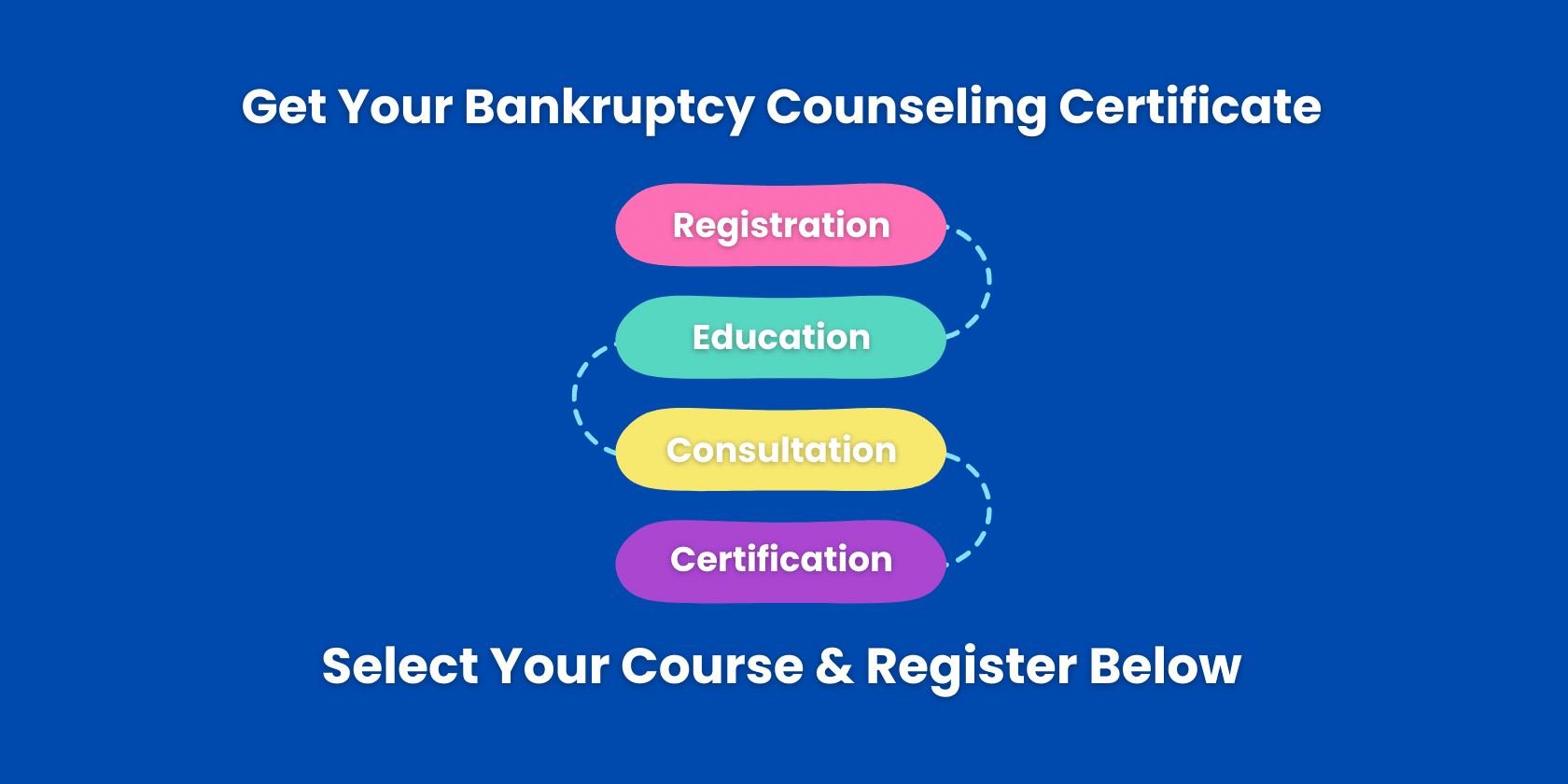

Credit Counseling Course Online For Chapter 13 - Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require you to get a certificate that proves you have gone through. These may not be provided at the same time. The purpose of this bankruptcy course is to help you remain financially secure and use credit wisely so you don’t end up in bankruptcy again. Complete the course at your. You can shop around to find a credit counseling. But do i even need to retake the course if i am converting to chapter 7? Discover expert guidance in navigating the complexities of bankruptcy with approved credit counseling. Bankruptcy credit counseling course for bankruptcy filers, debtorcc.org is a u.s. Get loan offer in minutesup to $100kone low monthly payment Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case can be filed with the bankruptcy court. Get loan offer in minutesup to $100kone low monthly payment If the cc course is not completed before filing, the case could be. These may not be provided at the same time. Once you complete the course you will receive a certificate that. Before you file for bankruptcy you need to take a credit counseling course that has been approved for illinois bankruptcy filers. But do i even need to retake the course if i am converting to chapter 7? Once you have filed your chapter 7 or chapter 13 bankruptcy petition with the bankruptcy court, the 2005 update to the united states’ bankruptcy law (bapcpa) will require you to complete a. Before bankruptcy is discharged, you must attain a personal finance management course known as debtor education. The purpose of this bankruptcy course is to help you remain financially secure and use credit wisely so you don’t end up in bankruptcy again. Considering chapter 7 or 13 bankruptcy? This has to be done. The purpose of credit counseling is to help you evaluate. What is credit counseling certification? Once you complete the course you will receive a certificate that. You can shop around to find a credit counseling. Discover expert guidance in navigating the complexities of bankruptcy with approved credit counseling. I originally filed chapter 13 in 2012, so the original credit counseling certificate has long expired. This has to be done. The purpose of credit counseling is to help you evaluate. Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require you. Once you have filed your chapter 7 or chapter 13 bankruptcy petition with the bankruptcy court, the 2005 update to the united states’ bankruptcy law (bapcpa) will require you to complete a. The purpose of credit counseling is to help you evaluate. What is credit counseling certification? Before you actually file for chapter 7 or chapter 13 bankruptcy, the court. I originally filed chapter 13 in 2012, so the original credit counseling certificate has long expired. Bankruptcy credit counseling course for bankruptcy filers, debtorcc.org is a u.s. Receive your certificate immediately after. Get loan offer in minutesup to $100kone low monthly payment Once you complete the course you will receive a certificate that. Once you have filed your chapter 7 or chapter 13 bankruptcy petition with the bankruptcy court, the 2005 update to the united states’ bankruptcy law (bapcpa) will require you to complete a. This has to be done. You can shop around to find a credit counseling. I originally filed chapter 13 in 2012, so the original credit counseling certificate has. Bankruptcy credit counseling course for bankruptcy filers, debtorcc.org is a u.s. Once you have filed your chapter 7 or chapter 13 bankruptcy petition with the bankruptcy court, the 2005 update to the united states’ bankruptcy law (bapcpa) will require you to complete a. These may not be provided at the same time. I originally filed chapter 13 in 2012, so. The purpose of credit counseling is to help you evaluate. This has to be done. Once you complete the course you will receive a certificate that. I originally filed chapter 13 in 2012, so the original credit counseling certificate has long expired. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. Before bankruptcy is discharged, you must attain a personal finance management course known as debtor education. If the cc course is not completed before filing, the case could be. What is credit counseling certification? You can shop around to find a credit counseling. Explore our essential courses today. Before bankruptcy is discharged, you must attain a personal finance management course known as debtor education. Receive your certificate immediately after. Discover expert guidance in navigating the complexities of bankruptcy with approved credit counseling. You can shop around to find a credit counseling. Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case. Explore our essential courses today. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. Complete the course at your. Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case can be filed with the bankruptcy court. Receive your certificate immediately after. I originally filed chapter 13 in 2012, so the original credit counseling certificate has long expired. Discover expert guidance in navigating the complexities of bankruptcy with approved credit counseling. Once you complete the course you will receive a certificate that. Get loan offer in minutesup to $100kone low monthly payment Everyone seeking chapter 13 bankruptcy relief has to complete a mandatory credit counseling class before their case can be filed with the bankruptcy court. The purpose of credit counseling is to help you evaluate. Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require you to get a certificate that proves you have gone through. The first bankruptcy course or credit counseling course must be completed before you file your chapter 13 bankruptcy petition. Considering chapter 7 or 13 bankruptcy? This has to be done. Receive your certificate immediately after. You can shop around to find a credit counseling. Before you file for bankruptcy you need to take a credit counseling course that has been approved for illinois bankruptcy filers. Explore our essential courses today. Once you have filed your chapter 7 or chapter 13 bankruptcy petition with the bankruptcy court, the 2005 update to the united states’ bankruptcy law (bapcpa) will require you to complete a. These may not be provided at the same time.Credit Counseling vs Chapter 13 YouTube

Bankruptcy Counseling & Debtor Education Money Fit

The PreBankruptcy Credit Counseling Course YouTube

Bankruptcy Credit Counseling Bonds Online

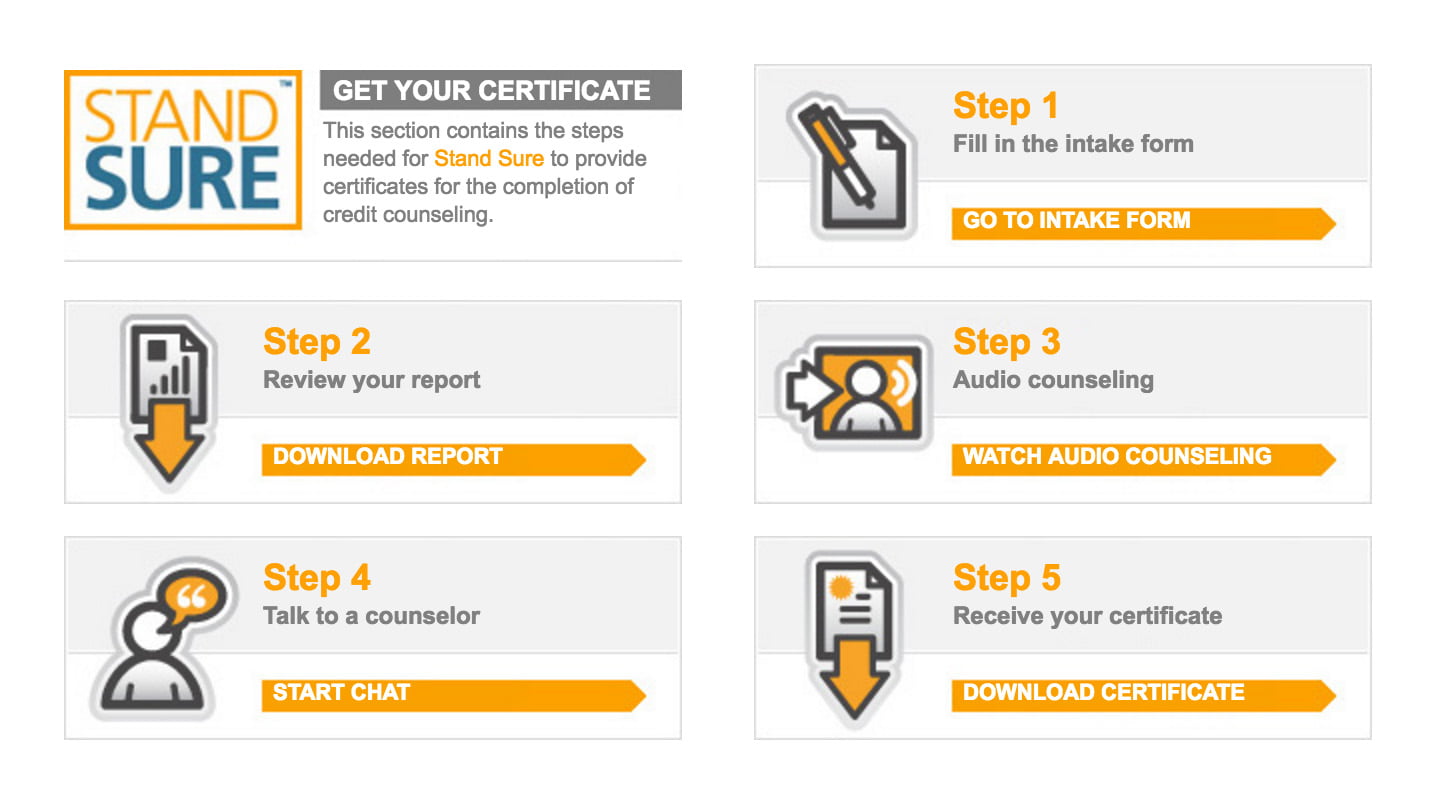

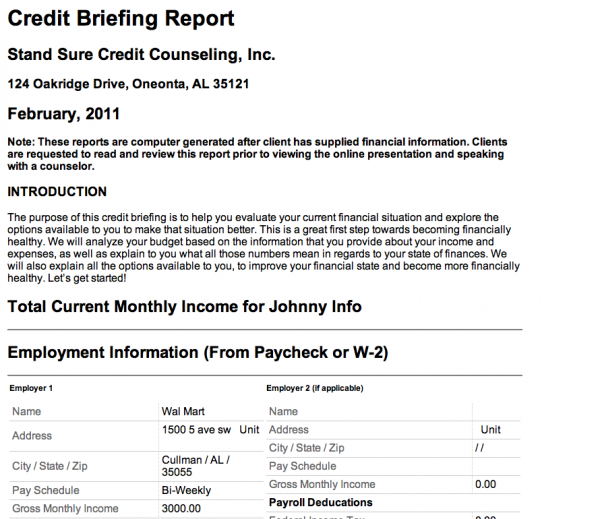

How Credit Counseling Works Course) Stand Sure Counseling

How Credit Counseling Works Course) Stand Sure Counseling

Completing Your Bankruptcy Credit Counseling Courses

Everything You Need To Know About the Required Bankruptcy Courses

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

How Does Online Credit Counseling Work? InCharge Debt Solutions

Bankruptcy Credit Counseling Course For Bankruptcy Filers, Debtorcc.org Is A U.s.

Credit Counseling (Cc) Must Be Obtained Before An Individual Files For Bankruptcy, Subject To Very Limited Exceptions.

What Is Credit Counseling Certification?

The Purpose Of This Bankruptcy Course Is To Help You Remain Financially Secure And Use Credit Wisely So You Don’t End Up In Bankruptcy Again.

Related Post: