Crra Utility Function Equity Premium Course Problems

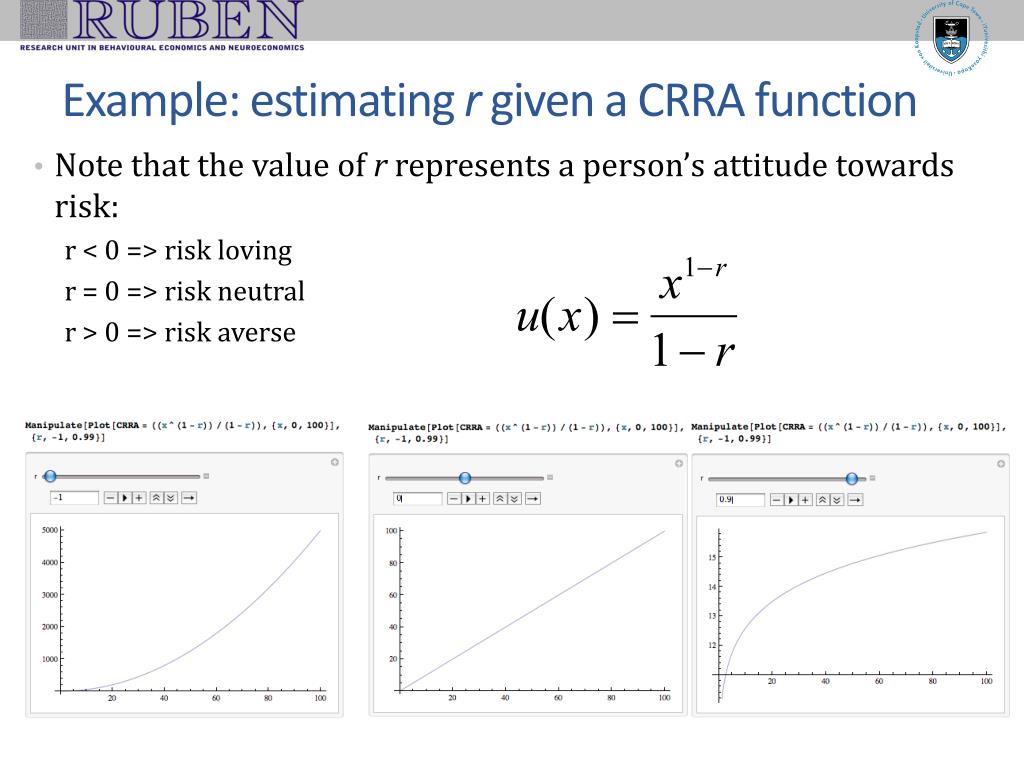

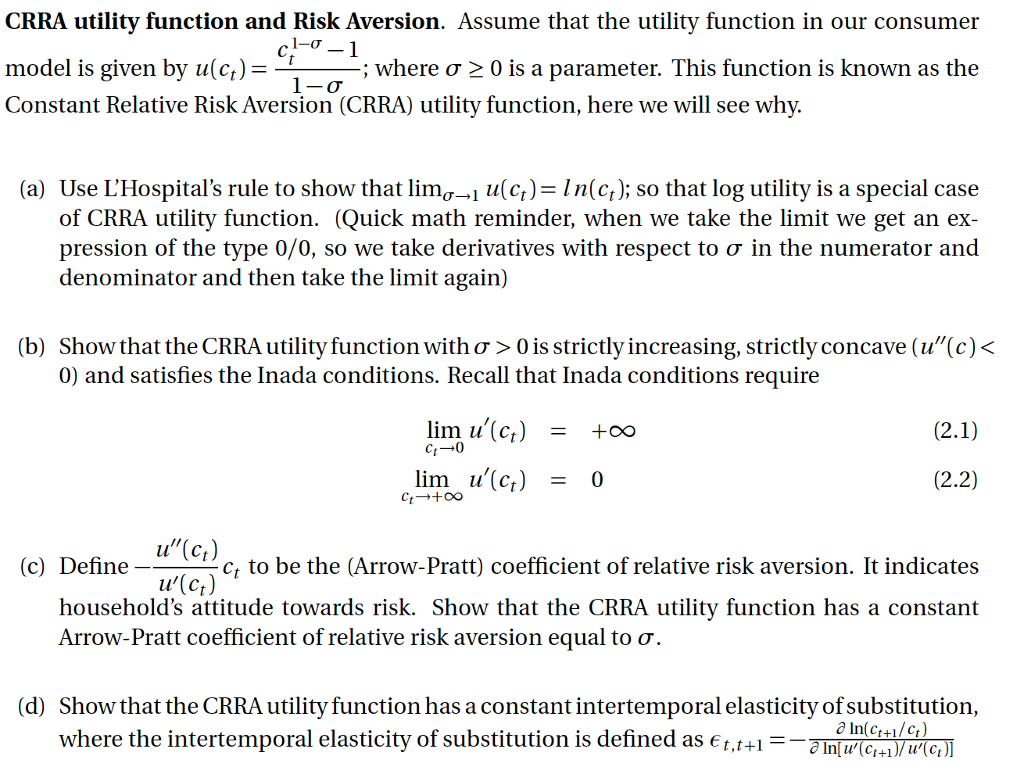

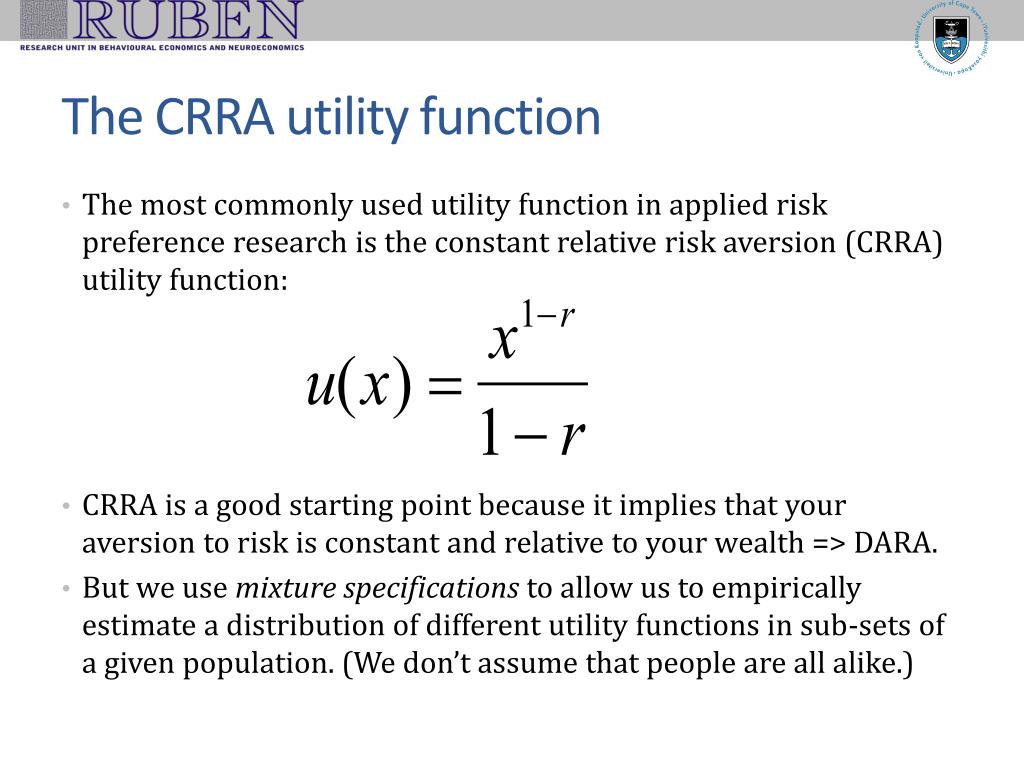

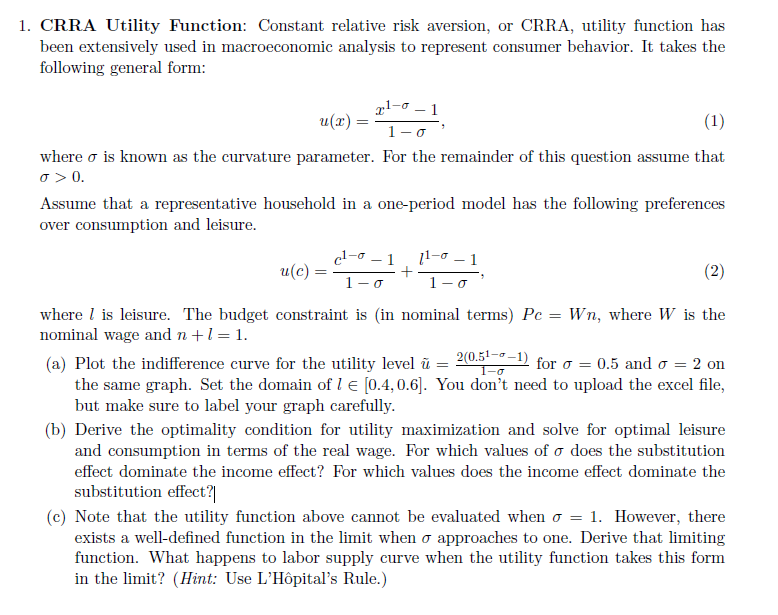

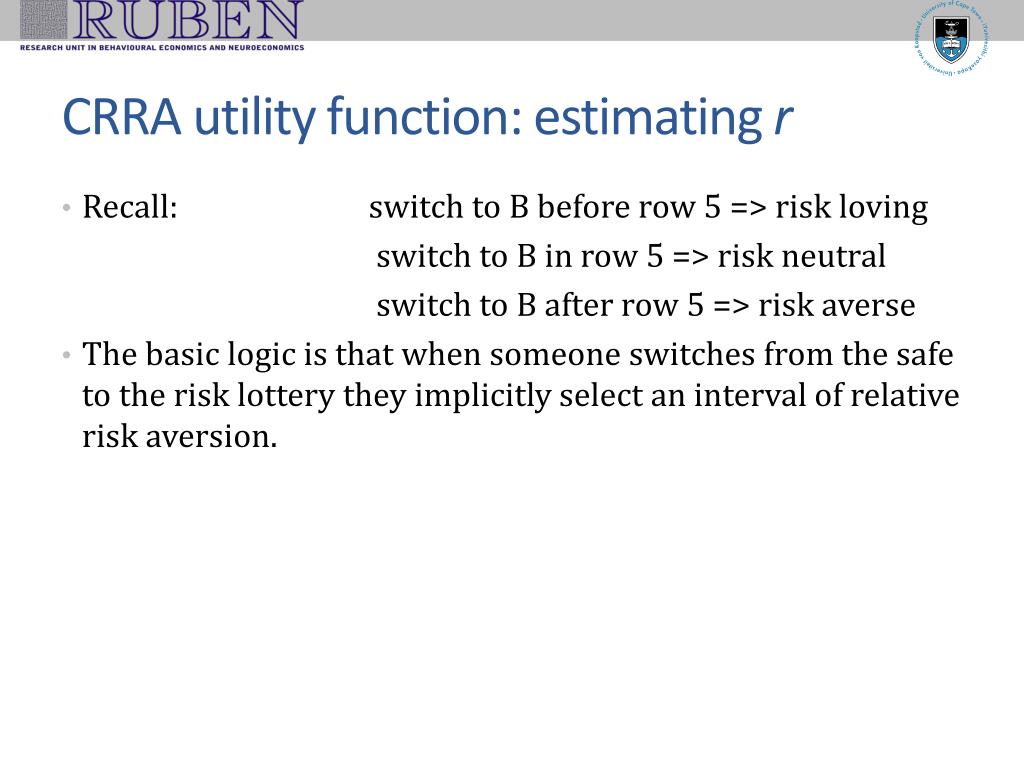

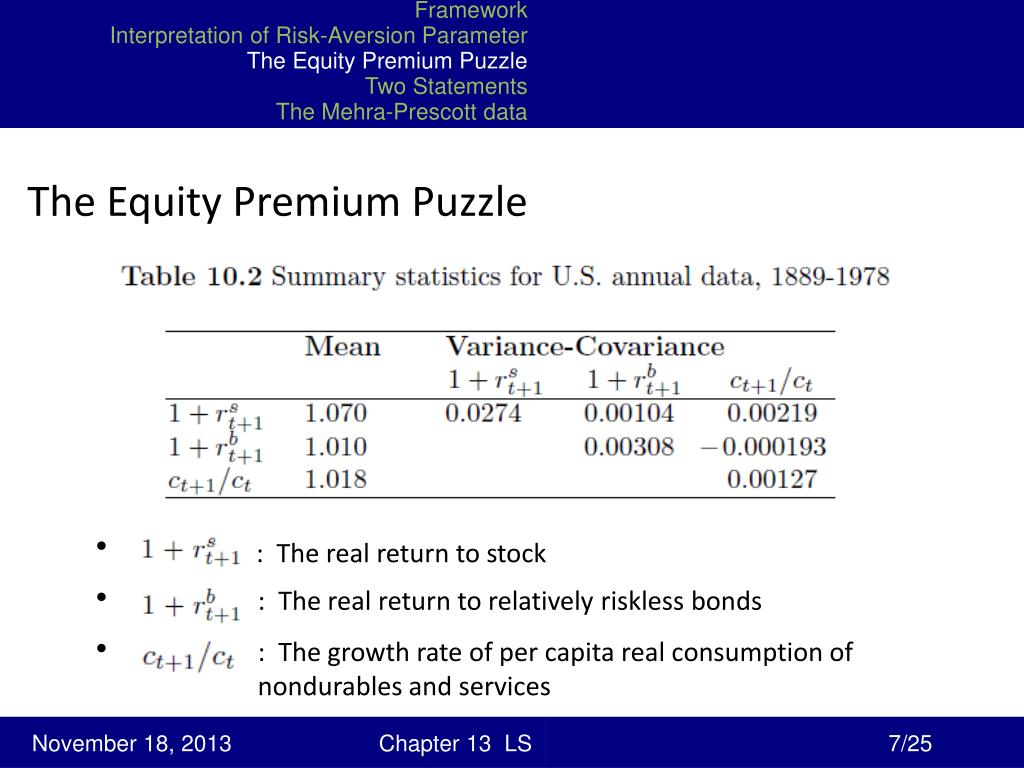

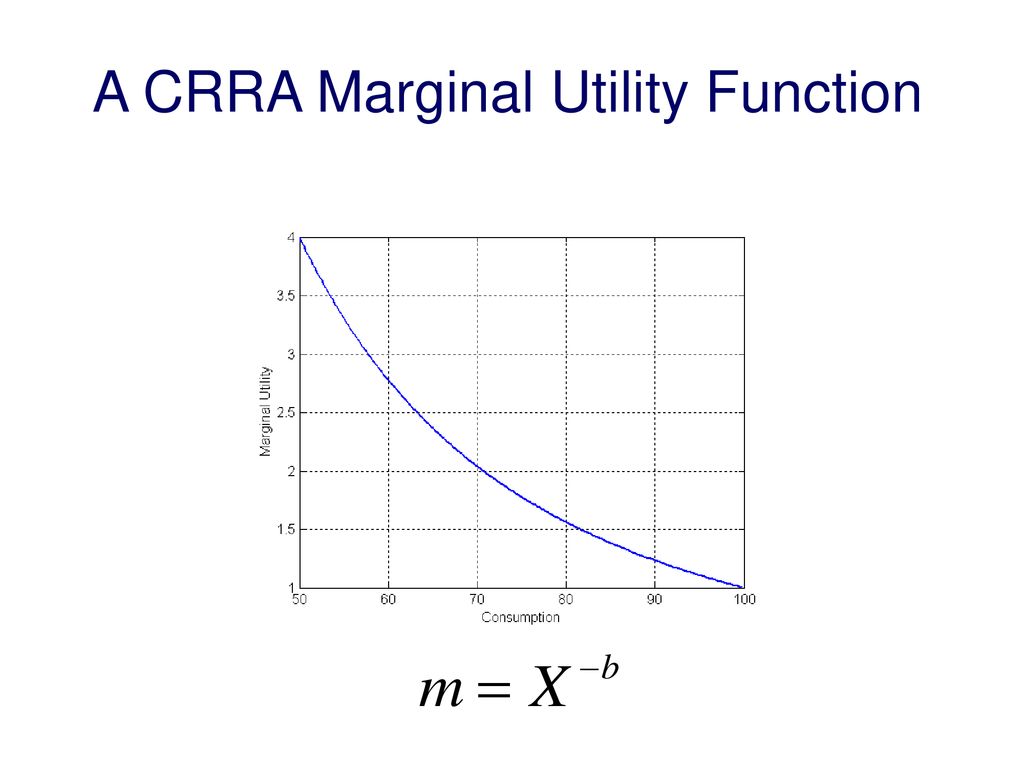

Crra Utility Function Equity Premium Course Problems - Discuss the commonly used power utility function with the crra and discuss reasonable values for the crra using a thought experiment. The decision, at the moment, is between crra and quadratic utility. We will replicate mehra and prescott’s Because of this we can’t increase. One of the most widespread utility functions in macroeconomics is the constant relative risk aversion) utility function (crra): The parameter, ˙represents the arrow. Constant relative risk aversion (crra) utility exhibits γ( w ) = γ using the definition γ( w ) = − u ( w ) w / u ( w ) , recover the utility function To avoid the problems caused by a prediction of a risky portfolio share greater than one, we can calibrate the model with more modest expectations for the equity premium. This allows us to use dp to characterize. (a) recall the definition of the stochastic discount factor. They are reciprocal of each other. (a) recall the definition of the stochastic discount factor. The crra utility function models an. One of the most widespread utility functions in macroeconomics is the constant relative risk aversion) utility function (crra): Constant relative risk aversion (crra) utility exhibits γ( w ) = γ using the definition γ( w ) = − u ( w ) w / u ( w ) , recover the utility function Last time we solved the problem of the perfect retirement spending plan, assuming a fixed known real return, and a crra utility function. Either ˙ 2 x or ˙ x x we’ve expressed the. Constant relative risk aversion (crra) utility function, equity premium, course problems, and students are inextricably linked. This allows us to use dp to characterize. (where we have used y0 = x0y). Most frequently used class of utility functions for modelling the investment policy of individual agents by the constant relative risk aversion (crra) utility functions. The decision, at the moment, is between crra and quadratic utility. The crra utility function models an. The key first order condition is. U(c) = c1 ˙ 1 1 ˙: The parameter, ˙represents the arrow. (where we have used y0 = x0y). The decision, at the moment, is between crra and quadratic utility. U(c) = c1 ˙ 1 1 ˙: Last time we solved the problem of the perfect retirement spending plan, assuming a fixed known real return, and a crra utility function. This time, we’ll try to look at the problem. (where we have used y0 = x0y). The crra and the cara utility functions. Either a( x) or r( x) extent of uncertainty of outcome: The key first order condition is. Either ˙ 2 x or ˙ x x we’ve expressed the. Constant relative risk aversion (crra) utility exhibits γ( w ) = γ using the definition γ( w ) = − u ( w ) w / u ( w ) , recover the utility function U(c) = c1 ˙ 1 1 ˙: We will replicate mehra and prescott’s The. One of the most widespread utility functions in macroeconomics is the constant relative risk aversion) utility function (crra): Either ˙ 2 x or ˙ x x we’ve expressed the. Constant relative risk aversion (crra) utility exhibits γ( w ) = γ using the definition γ( w ) = − u ( w ) w / u ( w ) ,. Either ˙ 2 x or ˙ x x we’ve expressed the. Constant relative risk aversion (crra) utility function, equity premium, course problems, and students are inextricably linked. The associated envelope condition is. They are reciprocal of each other. Either a( x) or r( x) extent of uncertainty of outcome: We can begin to solve the problem by finding the equilibrium price for equity. The associated envelope condition is. (where we have used y0 = x0y). The parameter, ˙represents the arrow. The crra and the cara utility functions. We can begin to solve the problem by finding the equilibrium price for equity. Constant relative risk aversion (crra) utility function, equity premium, course problems, and students are inextricably linked. To avoid the problems caused by a prediction of a risky portfolio share greater than one, we can calibrate the model with more modest expectations for the equity premium. We. (a) recall the definition of the stochastic discount factor. Most frequently used class of utility functions for modelling the investment policy of individual agents by the constant relative risk aversion (crra) utility functions. Either ˙ 2 x or ˙ x x we’ve expressed the. This allows us to use dp to characterize. Because of this we can’t increase. U(c) = c1 ˙ 1 1 ˙: (a) recall the definition of the stochastic discount factor. Discuss the commonly used power utility function with the crra and discuss reasonable values for the crra using a thought experiment. They are reciprocal of each other. (where we have used y0 = x0y). The parameter, ˙represents the arrow. Most frequently used class of utility functions for modelling the investment policy of individual agents by the constant relative risk aversion (crra) utility functions. The decision, at the moment, is between crra and quadratic utility. They are reciprocal of each other. To avoid the problems caused by a prediction of a risky portfolio share greater than one, we can calibrate the model with more modest expectations for the equity premium. Because of this we can’t increase. Either a( x) or r( x) extent of uncertainty of outcome: Either ˙ 2 x or ˙ x x we’ve expressed the. (a) recall the definition of the stochastic discount factor. Last time we solved the problem of the perfect retirement spending plan, assuming a fixed known real return, and a crra utility function. (where we have used y0 = x0y). We will replicate mehra and prescott’s Crra utility imposes a very tight link between the relative risk aversion and the elasticity of intertemporal substitution: Constant relative risk aversion (crra) utility exhibits γ( w ) = γ using the definition γ( w ) = − u ( w ) w / u ( w ) , recover the utility function The crra utility function models an. The crra and the cara utility functions.Solved 1. CRRA Utility Function Constant relative risk

PPT Utility and consistency PowerPoint Presentation, free download

PPT The Equity Premium Puzzle PowerPoint Presentation, free download

William F. Sharpe STANCO 25 Professor of Finance ppt download

Microfundations The ISLMAD model ppt download

PPT Utility and consistency PowerPoint Presentation, free download

Solved CRRA utility function and Risk Aversion. Assume that

Example CRRA utility functions Download Scientific Diagram

Maximum Likelihood Estimation of Utility Functions Using Stata ppt

PPT Utility and consistency PowerPoint Presentation, free download

The Associated Envelope Condition Is.

U(C) = C1 ˙ 1 1 ˙:

This Time, We’ll Try To Look At The Problem.

The Key First Order Condition Is.

Related Post:

+are+CRRA.jpg)