Free Cpe Ethics Course

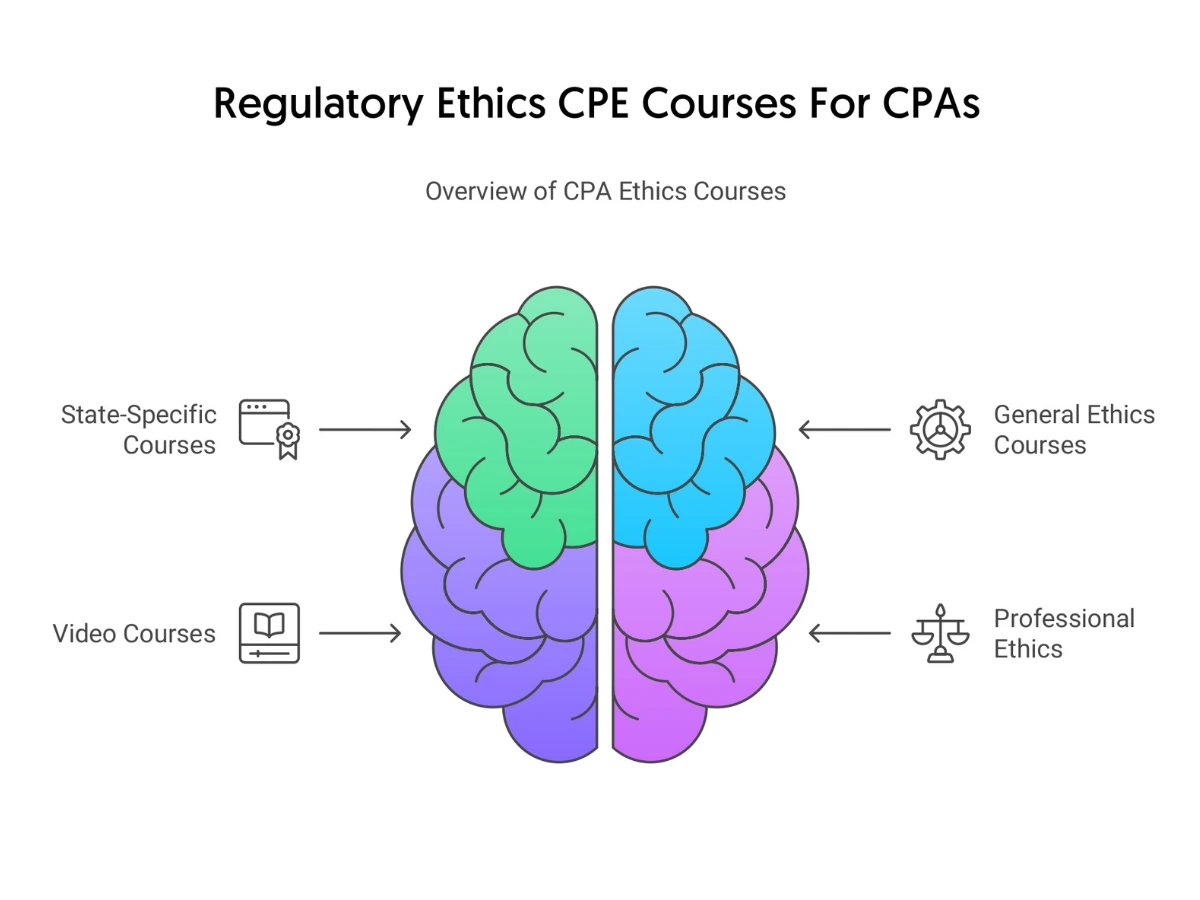

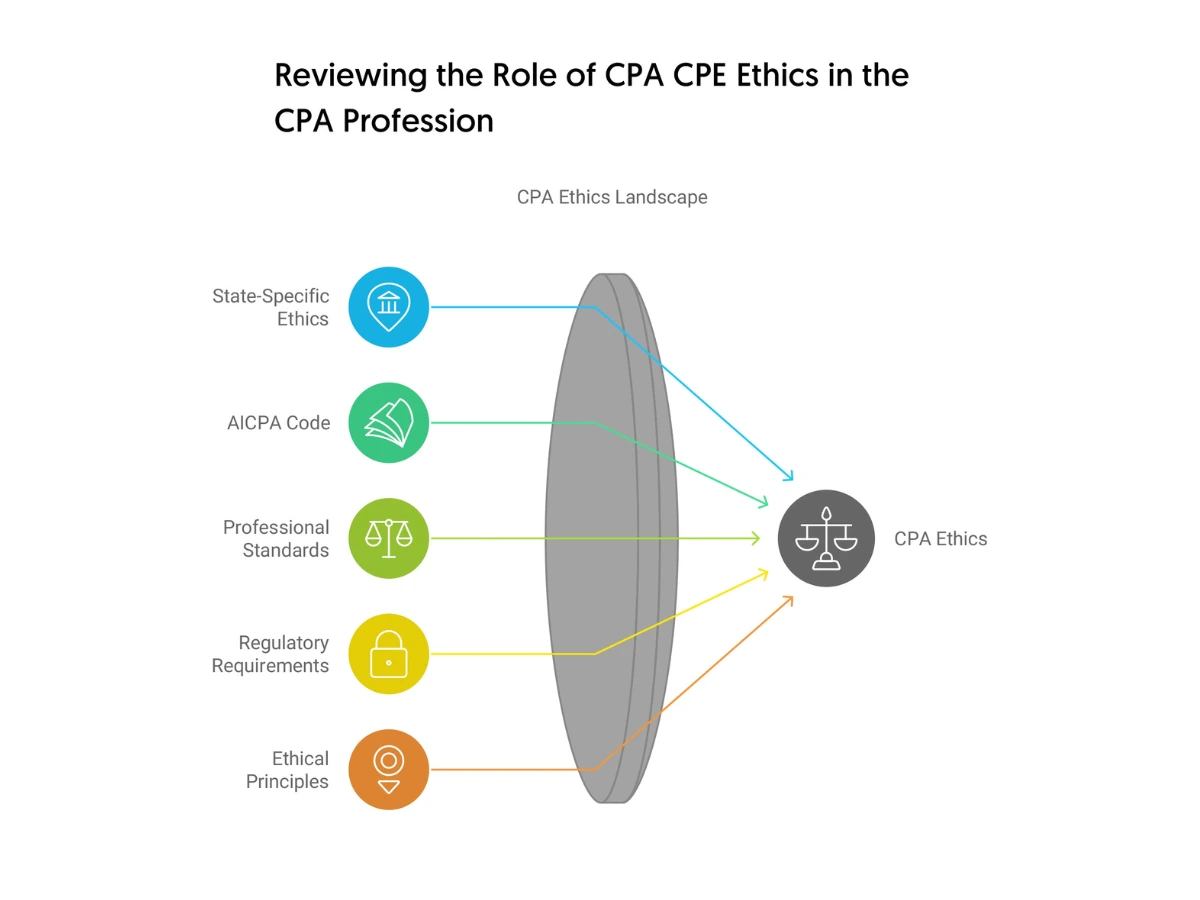

Free Cpe Ethics Course - Get your free cpe course and get cpe credit, too. Nasba approved aicpa 2 hours ethics course for cpas. The american institute of certified public accountants' comprehensive course (for licensure) It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. Choose from a list of on demand courses and webinars. This course qualifies for ethics cpe. Check your state board for requirements before you commit. Take advantage of free ethics cpe from these webinars to help satisfy your cpa license renewal requirements. Competitive pricingcredit hour varietydownloadable contentaccurate & timely courses Check your state board for requirements before you commit. Take advantage of free ethics cpe from these webinars to help satisfy your cpa license renewal requirements. Nasba approved aicpa 2 hours ethics course for cpas. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits Get free cpe webinars in your inbox every week, as well as access to our cpe resource center. Irs stakeholder liaison and the irs. This course qualifies for ethics cpe. Choose from a list of on demand courses and webinars. The american institute of certified public accountants' comprehensive course (for licensure) It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. The american institute of certified public accountants' comprehensive course (for licensure) As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. The webinars are free and often offer continuing education (ce) credit for enrolled agents and other tax return preparers with valid ptins. It supports professional development in accounting professionals and equips them. Check your state board for requirements before you commit. This course qualifies for ethics cpe. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. Irs stakeholder liaison and the irs. The webinars are free and often offer continuing education (ce) credit for enrolled agents and other tax return preparers with valid ptins. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. Get your illinois cpa continuing education courses online at cpe think. Irs stakeholder liaison and the irs. Check your state board for requirements before you commit. The cpe planner provides free resources for busy cpas, including a calendar of free cpe. Check your state board for requirements before you commit. Choose from a list of on demand courses and webinars. Get free cpe webinars in your inbox every week, as well as access to our cpe resource center. Irs stakeholder liaison and the irs. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits Get free cpe webinars in your inbox every week, as well as access to our cpe resource center. The cpe planner provides free resources for busy cpas, including a calendar of free cpe. The webinars are free and often offer continuing education (ce) credit for enrolled agents and other. Get your illinois cpa continuing education courses online at cpe think. It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. The cpe planner provides free resources for busy cpas, including a calendar of free cpe. Try a free cpe course Get your free cpe course. Get your illinois cpa continuing education courses online at cpe think. Competitive pricingcredit hour varietydownloadable contentaccurate & timely courses This course qualifies for ethics cpe. The american institute of certified public accountants' comprehensive course (for licensure) Check your state board for requirements before you commit. Take advantage of free ethics cpe from these webinars to help satisfy your cpa license renewal requirements. Irs stakeholder liaison and the irs. Nasba approved aicpa 2 hours ethics course for cpas. Competitive pricingcredit hour varietydownloadable contentaccurate & timely courses Choose from a list of on demand courses and webinars. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. The cpe planner provides free resources for busy cpas, including a calendar of free cpe. Get your free cpe course and get cpe credit, too. Take advantage of free ethics cpe from these webinars to help satisfy your cpa license renewal requirements. Get. Get your free cpe course and get cpe credit, too. Take advantage of free ethics cpe from these webinars to help satisfy your cpa license renewal requirements. Choose from a list of on demand courses and webinars. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. This course qualifies for ethics cpe. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. Get your illinois cpa continuing education courses online at cpe think. The american institute of certified public accountants' comprehensive course (for licensure) Get your free cpe course and get cpe credit, too. Get free cpe webinars in your inbox every week, as well as access to our cpe resource center. Irs stakeholder liaison and the irs. Check your state board for requirements before you commit. Cpe credits for cpaswebinars & seminarscpe credits for easunlimited cpe credits Choose from a list of on demand courses and webinars. The cpe planner provides free resources for busy cpas, including a calendar of free cpe. Competitive pricingcredit hour varietydownloadable contentaccurate & timely courses The webinars are free and often offer continuing education (ce) credit for enrolled agents and other tax return preparers with valid ptins. It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public.Regulatory CPE Ethics Courses Online CPE Ethics Courses

Explore NASBAApproved CPE Ethics Courses by CPE Credit Professional

Ethics Courses Online Learning for Moral Values CPE World

CPA CPE Ethics Ethics Online CPA Courses CPE Think

Find Your Ethics CPE Credits Here! VTR Learning

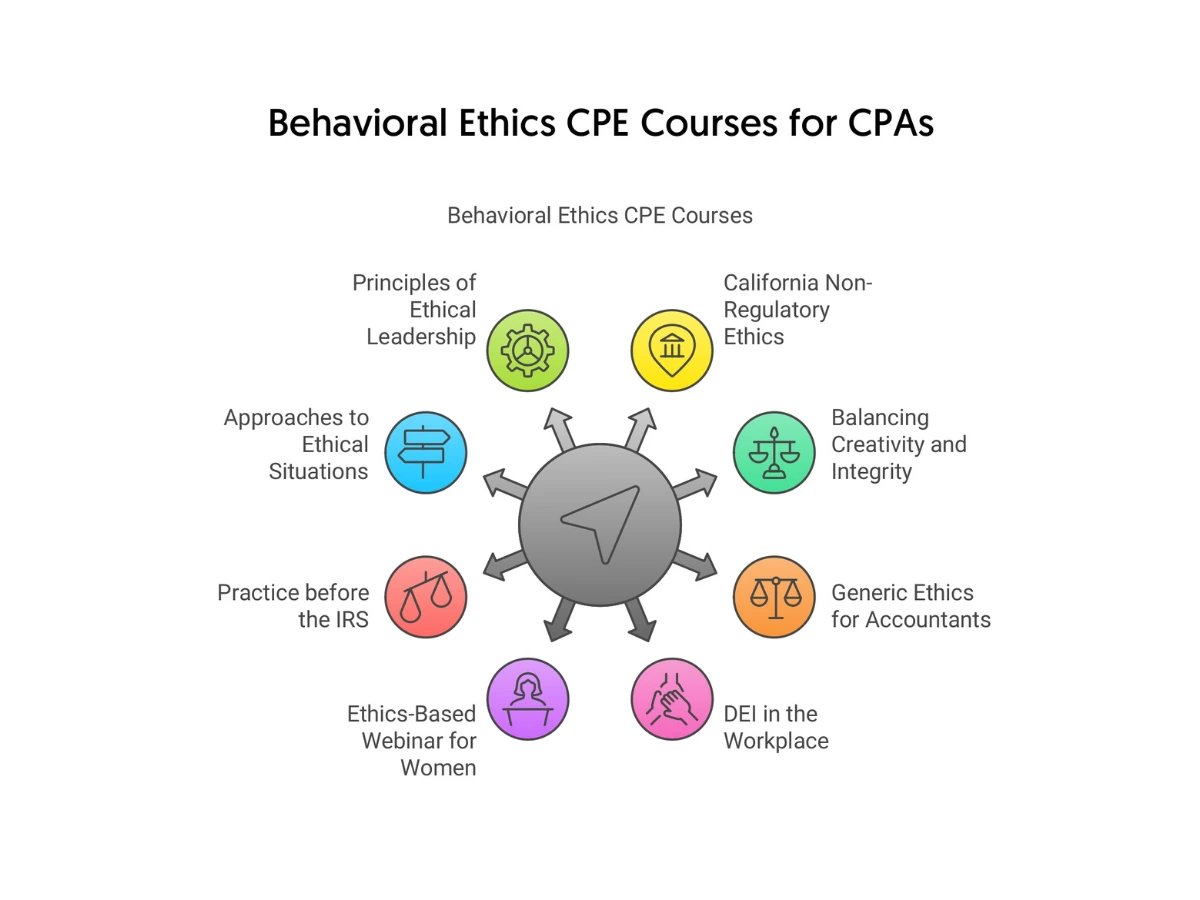

Behavioral Ethics CPE Courses for CPAs Online CPEThink

Professional Ethics for CPAS • 4 hr online CPE course

Are there any free professional ethics courses for... Fishbowl

AICPA Ethics 3 hr Online CPE Course • JN CPE Courses

Ethics Courses Online Learning for Moral Values CPE World

Try A Free Cpe Course

Nasba Approved Aicpa 2 Hours Ethics Course For Cpas.

Take Advantage Of Free Ethics Cpe From These Webinars To Help Satisfy Your Cpa License Renewal Requirements.

This Course Qualifies For Ethics Cpe.

Related Post: