Life Insurance Course Cost

Life Insurance Course Cost - Kaplan can help you earn a variety of state insurance licenses, including life, health, property, casualty, adjuster, and personal lines. The standard fee for the life insurance licensing. From live online classes to ondemand courses to self. The process can take anywhere from several weeks to several months, but it is worth the effort. Once you pass the life insurance exam, you must wait five days after passing your exam to apply for your illinois life insurance license. It is also important to note that some insurance carriers. To get your life insurance license, you must pass an exam and meet other requirements. The questions most frequently asked about life insurance licensing and the. From traditional live classes to. Once you pass the exam and complete your state’s application process, you will be a licensed. From live online classes to ondemand courses to self. Life insurance can help cover funeral costs, outstanding debts, and everyday living expenses, such as mortgage payments or education fees, allowing your clients’ families to maintain their. In most cases, you can expect to pay between $300 and $1,000. From traditional live classes to. This is sometimes referred to as “insurance with no medical” or “skip the medical exam life insurance.” options include accelerated underwriting, simplified issue life insurance,. The process can take anywhere from several weeks to several months, but it is worth the effort. The application fee is $215, and the nipr. The standard fee for the life insurance licensing. Once you pass the life insurance exam, you must wait five days after passing your exam to apply for your illinois life insurance license. Kaplan financial education offers diversified life and health insurance prelicensing packages and tools tailored to fit a variety of budgets and learning styles. Depending on your state, you may need to take a course, pass an insurance exam, or both. Kaplan can help you earn a variety of state insurance licenses, including life, health, property, casualty, adjuster, and personal lines. The cost of obtaining a life insurance license varies significantly depending on the state you reside in,. It is also important to note. From live online classes to ondemand courses to self. The life insurance exam is required for anyone who plans to sell life insurance. It is also important to note that some insurance carriers. The application fee is $215, and the nipr. The cost of obtaining a life insurance license varies significantly depending on the state you reside in,. The most common type of life insurance license is. Upon course completion and after earning your life. 2 the cost and number of hours differ by state, so you should check with the department of insurance of the state (s) where you want to sell life insurance, to review the training requirements and life insurance licensing rules. Kaplan financial education. New york has lower licensing fees compared to florida. Upon course completion and after earning your life. From live online classes to ondemand courses to self. Depending on your state, you may need to take a course, pass an insurance exam, or both. In most cases, you can expect to pay between $300 and $1,000. Upon course completion and after earning your life. The cost of obtaining a life insurance license varies significantly depending on the state you reside in,. In most cases, you can expect to pay between $300 and $1,000. The process can take anywhere from several weeks to several months, but it is worth the effort. Prelicensing education is a necessary step. Once you pass the exam and complete your state’s application process, you will be a licensed. From live online classes to ondemand courses to self. Once you pass the life insurance exam, you must wait five days after passing your exam to apply for your illinois life insurance license. Prelicensing education is a necessary step before taking the licensing exam,. Kaplan can help you earn a variety of state insurance licenses, including life, health, property, casualty, adjuster, and personal lines. 2 the cost and number of hours differ by state, so you should check with the department of insurance of the state (s) where you want to sell life insurance, to review the training requirements and life insurance licensing rules.. The most common type of life insurance license is. The application fee is $215, and the nipr. Life insurance can help cover funeral costs, outstanding debts, and everyday living expenses, such as mortgage payments or education fees, allowing your clients’ families to maintain their. Kaplan can help you earn a variety of state insurance licenses, including life, health, property, casualty,. Life insurance can help cover funeral costs, outstanding debts, and everyday living expenses, such as mortgage payments or education fees, allowing your clients’ families to maintain their. The application fee is $215, and the nipr. Once you pass the life insurance exam, you must wait five days after passing your exam to apply for your illinois life insurance license. Kaplan. It is also important to note that some insurance carriers. Kaplan can help you earn a variety of state insurance licenses, including life, health, property, casualty, adjuster, and personal lines. Once you pass the life insurance exam, you must wait five days after passing your exam to apply for your illinois life insurance license. This is sometimes referred to as. From live online classes to ondemand courses to self. Prelicensing education is a necessary step before taking the licensing exam, and the cost of these courses. Upon course completion and after earning your life. Once you pass the exam and complete your state’s application process, you will be a licensed. Congrats on passing your life and health course! This is sometimes referred to as “insurance with no medical” or “skip the medical exam life insurance.” options include accelerated underwriting, simplified issue life insurance,. In most cases, you can expect to pay between $300 and $1,000. The questions most frequently asked about life insurance licensing and the. It is also important to note that some insurance carriers. Life insurance can help cover funeral costs, outstanding debts, and everyday living expenses, such as mortgage payments or education fees, allowing your clients’ families to maintain their. The process can take anywhere from several weeks to several months, but it is worth the effort. New york has lower licensing fees compared to florida. The life insurance exam is required for anyone who plans to sell life insurance. Depending on your state, you may need to take a course, pass an insurance exam, or both. The cost of obtaining a life insurance license varies significantly depending on the state you reside in,. 2 the cost and number of hours differ by state, so you should check with the department of insurance of the state (s) where you want to sell life insurance, to review the training requirements and life insurance licensing rules.How much does life insurance cost?

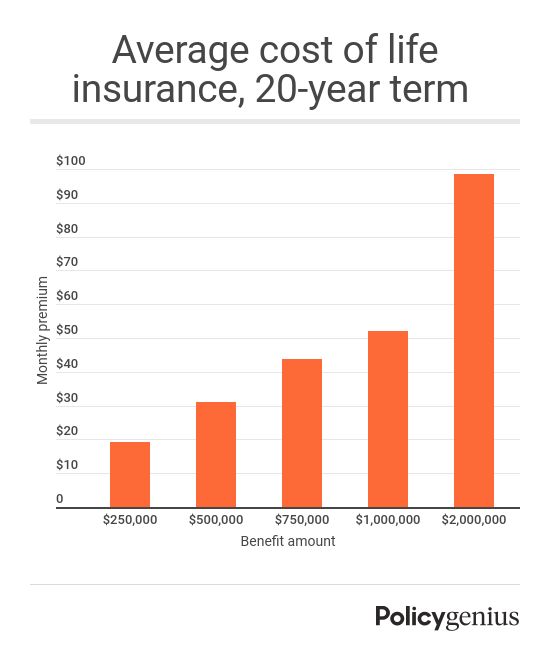

Life Insurance Rates Policygenius

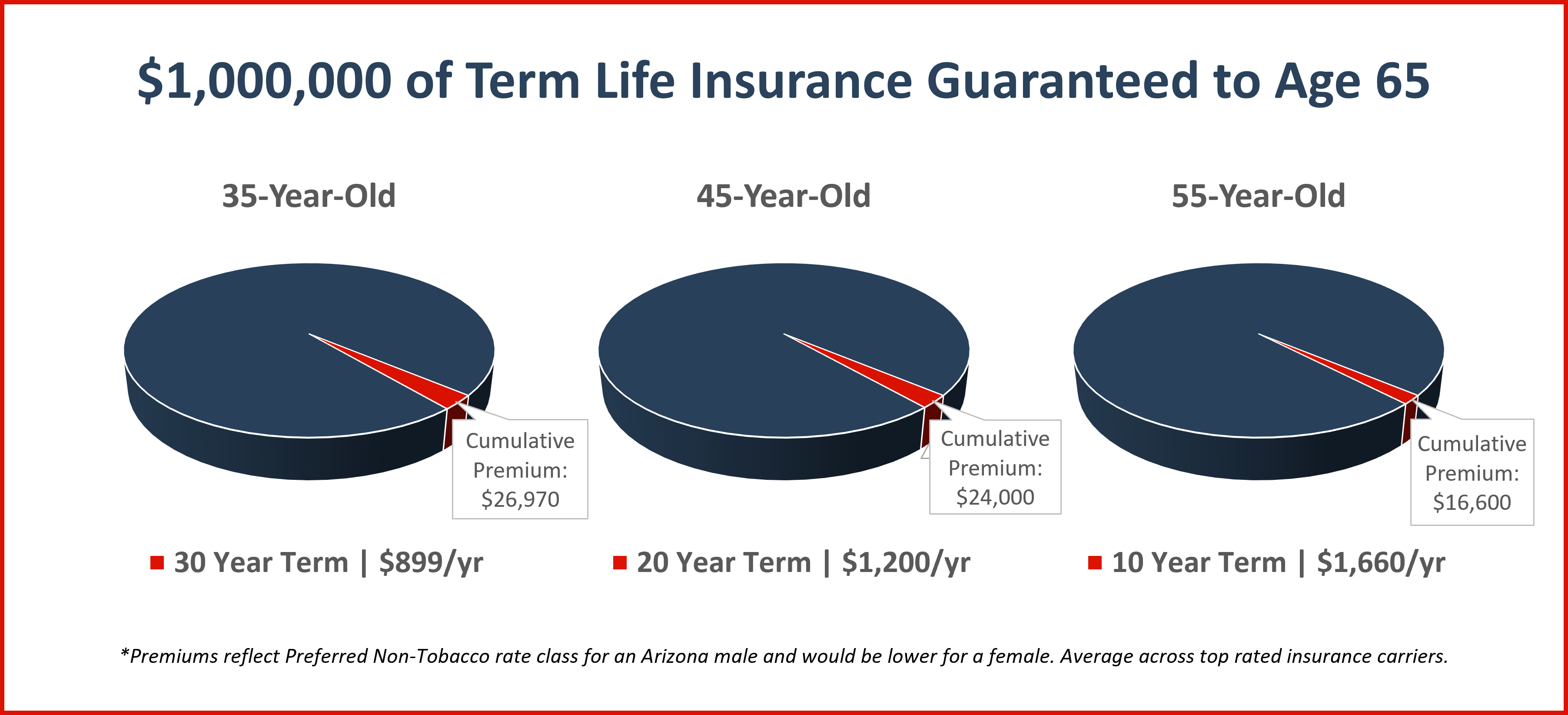

Insuring Your Economic Value with Term Life Insurance Risk Resource

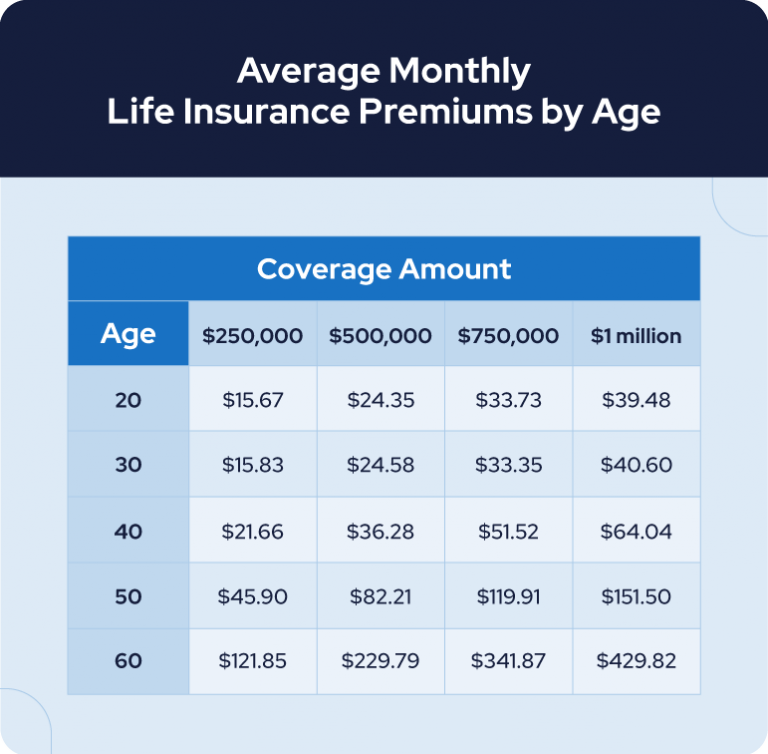

Life Insurance at Various Life Stages Prairie Plans Asset Management

Facts About Life Insurance MustKnow Statistics in 2022 Barwick

million dollar life insurance policy payout Boris Lockwood

How Does Life Insurance Work? The Basics of Life Insurance Explained

How Much Does Life Insurance Cost? Fidelity Life

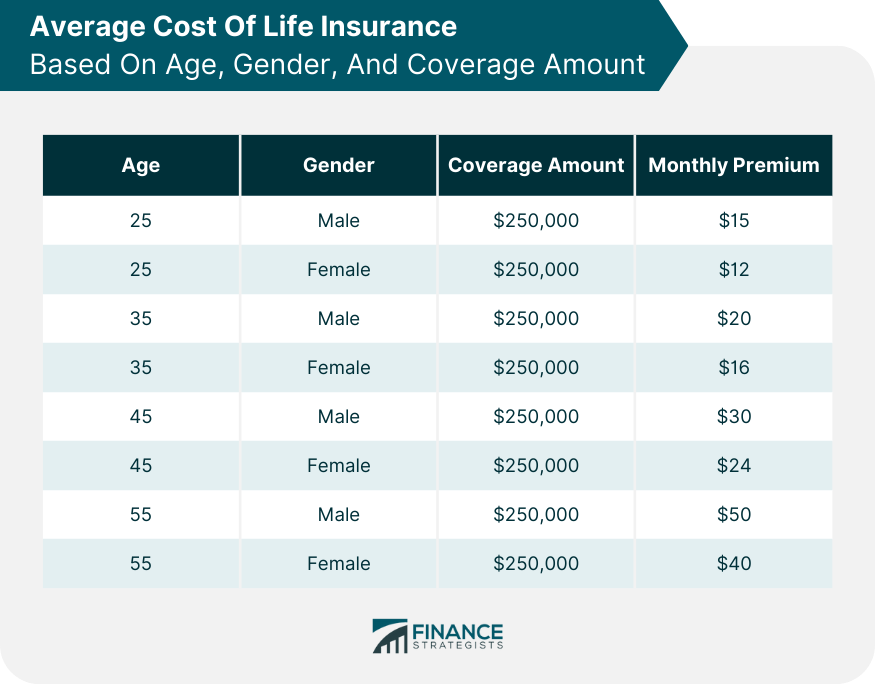

Average Cost of Life Insurance Factors That Affect It

Life Insurance for to Canada PolicyAdvisor

To Get Your Life Insurance License, You Must Pass An Exam And Meet Other Requirements.

Kaplan Financial Education Offers Diversified Life And Health Insurance Prelicensing Packages And Tools Tailored To Fit A Variety Of Budgets And Learning Styles.

The Most Common Type Of Life Insurance License Is.

From Traditional Live Classes To.

Related Post: