Online Accounting Courses For Cpa Credit

Online Accounting Courses For Cpa Credit - There are several ways to earn the credit hours you need to qualify for a cpa license. Learn about the online cpa prep certificate for the certified public accountant examination, and earn additional college credit at the same time at northwestern sps. When you take accounting cpa courses online, you get to enjoy unparalleled flexibility and convenience. Champlain's online accounting courses encompass the top skills needed by today's business professionals. Find out the best online courses for beginners and. Financial aid availabletop 10 online universityonline degree programs Increased level of professional credibility; Meet your state requirements and stay current. Get a comprehensive introduction to the u.s. Get tax, accounting, auditing and finance knowledge and accumulate the credits needed to sit for the cpa exam. Get a comprehensive introduction to the u.s. Expanded access to industry networks; Some of the most popular specializations,. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Snhu offers online cpa courses across three different certificate options: The most straightforward option is to get a master’s degree, such as an mba or a. Concepts covered include gross income, deductions and tax computations. Get tax, accounting, auditing and finance knowledge and accumulate the credits needed to sit for the cpa exam. Built for foundational accounting roles like bookkeeping, invoicing, and financial reporting ; Federal income tax system in this online accounting course. Built for foundational accounting roles like bookkeeping, invoicing, and financial reporting ; Meet your state requirements and stay current. Financial aid availabletop 10 online universityonline degree programs Get a comprehensive introduction to the u.s. Choose a variety of semester based online courses to earn the cpa credits in an easy and affordable way. Snhu offers online cpa courses across three different certificate options: Concepts covered include gross income, deductions and tax computations. Hone your critical thinking and problem solving skills to become an expert in. There are several ways to earn the credit hours you need to qualify for a cpa license. Mastercpe has high quality online courses for professionals, including unlimited cpe. Programs like becker cpa review, wiley cpaexcel, surgent cpa review, and roger cpa review offer online cpa review courses that grant academic credits in collaboration with. Possibility of increasing earning potential over the course of your career; Financial aid availabletop 10 online universityonline degree programs Federal income tax system in this online accounting course. Hone your critical thinking and problem. Increased level of professional credibility; The 150 credit hour rule. Serve communitiescommitment to excellencelearn valuable skillsinnovation Total tuition for the master’s in accounting program*: Financial aid availabletop 10 online universityonline degree programs Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Total tuition for the master’s in accounting program*: Possibility of increasing earning potential over the course of your career; Mastercpe has high quality online courses for professionals, including unlimited cpe credits and subscriptions for cpas. Choose from elective, business or accounting online courses. Mastercpe has high quality online courses for professionals, including unlimited cpe credits and subscriptions for cpas. Snhu offers online cpa courses across three different certificate options: Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. The program offers online courses through a tulane university professional education program at a reduced tuition rate. $25,170 *estimated tuition costs based on full credit hours for the ms in accounting degree. Some of the most popular specializations,. Get tax, accounting, auditing and finance knowledge and accumulate the credits needed to sit for the cpa exam. Choose a variety of semester based online courses to earn the cpa credits in an easy and affordable way. Get a. Find out the best online courses for beginners and. Financial aid availabletop 10 online universityonline degree programs The most straightforward option is to get a master’s degree, such as an mba or a. There are several ways to earn the credit hours you need to qualify for a cpa license. Serve communitiescommitment to excellencelearn valuable skillsinnovation Hone your critical thinking and problem solving skills to become an expert in. The 150 credit hour rule. Mastercpe has high quality online courses for professionals, including unlimited cpe credits and subscriptions for cpas. When you take accounting cpa courses online, you get to enjoy unparalleled flexibility and convenience. Possibility of increasing earning potential over the course of your career; Expanded access to industry networks; Get tax, accounting, auditing and finance knowledge and accumulate the credits needed to sit for the cpa exam. Snhu offers online cpa courses across three different certificate options: Choose a variety of semester based online courses to earn the cpa credits in an easy and affordable way. Total tuition for the master’s in accounting program*: The most straightforward option is to get a master’s degree, such as an mba or a. Hone your critical thinking and problem solving skills to become an expert in. Get a comprehensive introduction to the u.s. The program offers online courses through a tulane university professional education program at a reduced tuition rate to help accountants reach the cpa requirement of. Expanded access to industry networks; Programs like becker cpa review, wiley cpaexcel, surgent cpa review, and roger cpa review offer online cpa review courses that grant academic credits in collaboration with. When you take accounting cpa courses online, you get to enjoy unparalleled flexibility and convenience. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Mastercpe has high quality online courses for professionals, including unlimited cpe credits and subscriptions for cpas. There are several ways to earn the credit hours you need to qualify for a cpa license. Possibility of increasing earning potential over the course of your career; Choose a variety of semester based online courses to earn the cpa credits in an easy and affordable way. Snhu offers online cpa courses across three different certificate options: Increased level of professional credibility; Earning your master’s in accounting online and your cpa will also open you up to specializations that can enhance your career. Get tax, accounting, auditing and finance knowledge and accumulate the credits needed to sit for the cpa exam.ACCT 201 Accounting Principles I SelfPaced Course CPA Credits The

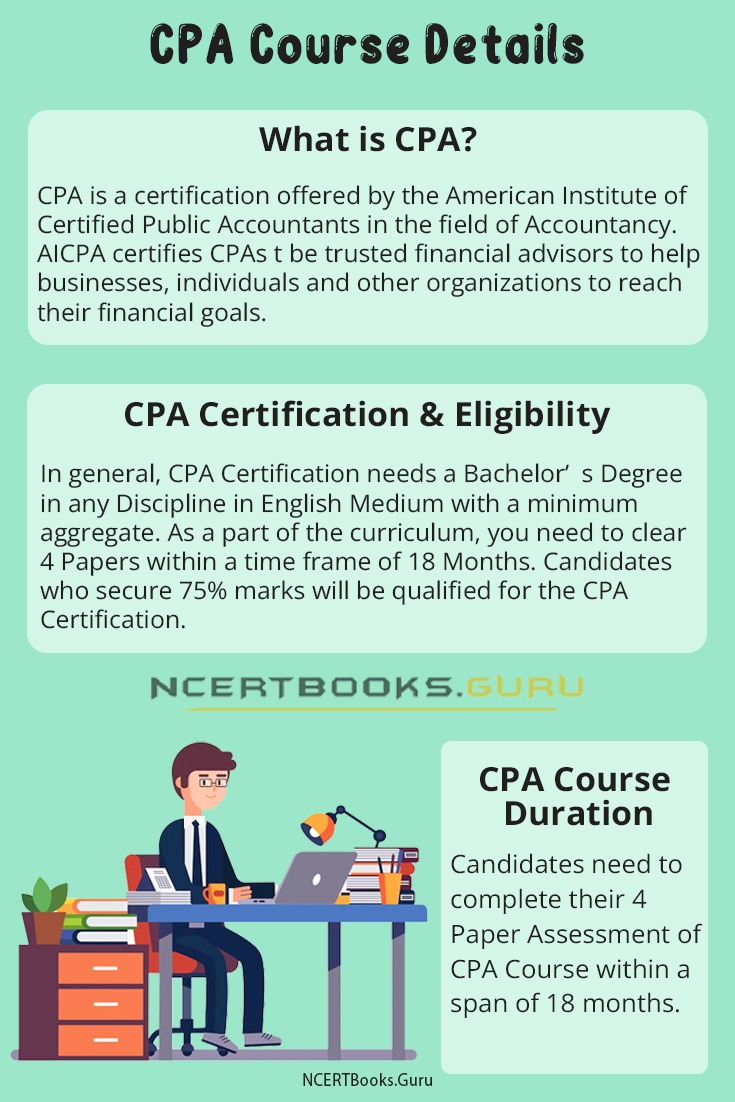

CPA Course Details Eligibility Criteria, Fee, Duration, Jobs, Scope

ACCT 322 Intermediate Financial Accounting II SelfPaced Course CPA

CPE Flow Expert Accounting & Finance Online Courses on LinkedIn CMAs

How to a CPA with an Online Accounting Degree LSU Online

CPE Courses, Online, Tax, Ethics, CPAs, Credits, Self Study, Accounting

ACCT 202 Accounting Principles II SelfPaced Course CPA Credits

CPA Classes Online for a Successful Accounting Career

CPA Course Details Certification Eligibility, Duration, Fees, Career

ACCT 321 Intermediate Financial Accounting I SelfPaced Course CPA

Business Analysis And Reporting, Information Systems And Controls, And Tax Compliance And Planning.

$25,170 *Estimated Tuition Costs Based On Full Credit Hours For The Ms In Accounting Degree.

Total Tuition For The Master’s In Accounting Program*:

Find Out The Best Online Courses For Beginners And.

Related Post: