Payroll Accounting Course

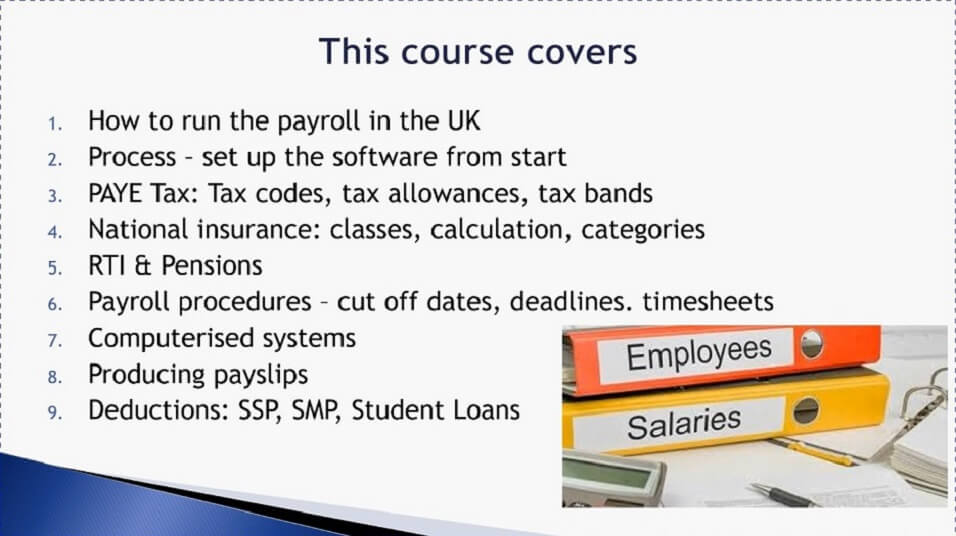

Payroll Accounting Course - We start with a brief overview of payroll accounting. We go over basic terminologies, important payroll formulas and data entry methods to explain the role and. At the end of a tax year, as part of payroll year end duties, payroll accounting provides the information needed to produce employees’ p60 forms. Explore our programs and essential resources to streamline your payroll processes. Payroll professionals play a pivotal role in ensuring that employees are paid accurately and on time while also maintaining compliance with relevant regulations and laws. This bookkeeping course lays out the fundamentals of payroll accounting. Identify the key federal payroll laws and regulations that govern. Payroll accounting is the process of recording and tracking compensation data, including independent contractor and employee wages, tax withholdings, and benefit. The payroll training center offers a variety of payroll seminars, webinars, and online payroll training courses, as well as the certified payroll administrator designation. Unlock the keys to payroll education with payo. The payroll training center offers a variety of payroll seminars, webinars, and online payroll training courses, as well as the certified payroll administrator designation. Payroll accounting is the process of recording and tracking compensation data, including independent contractor and employee wages, tax withholdings, and benefit. This bookkeeping course lays out the fundamentals of payroll accounting. To obtain a payroll certification, professionals must complete certification training, which typically culminates in an exam and covers a range of vital payroll topics. Prepare for certification & gain foundational skills with our payroll course online where you can learn about deductions, payments, and payroll accounting. Equip yourself with these strategic insights to transform your payroll accounting process into a model of efficiency and accuracy with our online payroll and accounting course. Explore our programs and essential resources to streamline your payroll processes. At the end of a tax year, as part of payroll year end duties, payroll accounting provides the information needed to produce employees’ p60 forms. We start with a brief overview of payroll accounting. Identify the key federal payroll laws and regulations that govern. Explore our programs and essential resources to streamline your payroll processes. With flexible, online courses, you'll learn how to become a payroll clerk and build essential industry skills on your schedule, from home. Equip yourself with these strategic insights to transform your payroll accounting process into a model of efficiency and accuracy with our online payroll and accounting course. At. With flexible, online courses, you'll learn how to become a payroll clerk and build essential industry skills on your schedule, from home. Up to 10% cash back this course prepares the learner with the basic knowledge needed to administer the accounting for payroll. Payroll accounting is how employers record, track and analyze their payroll transactions. Unlock the keys to payroll. We go over basic terminologies, important payroll formulas and data entry methods to explain the role and. This bookkeeping course lays out the fundamentals of payroll accounting. Payroll accounting is the process of recording and tracking compensation data, including independent contractor and employee wages, tax withholdings, and benefit. The payroll specialist certificate prepares students to perform activities associated with human. With flexible, online courses, you'll learn how to become a payroll clerk and build essential industry skills on your schedule, from home. Equip yourself with these strategic insights to transform your payroll accounting process into a model of efficiency and accuracy with our online payroll and accounting course. Prepare for certification & gain foundational skills with our payroll course online. Payroll accounting is how employers record, track and analyze their payroll transactions. To obtain a payroll certification, professionals must complete certification training, which typically culminates in an exam and covers a range of vital payroll topics. This bookkeeping course lays out the fundamentals of payroll accounting. We will discuss debits, credits, liabilities, and assets. Unlock the keys to payroll education. Payroll accounting is how employers record, track and analyze their payroll transactions. Master the complex world of payroll with practical examples, legislation insights, and comprehensive problems. Payroll professionals play a pivotal role in ensuring that employees are paid accurately and on time while also maintaining compliance with relevant regulations and laws. Explore our programs and essential resources to streamline your. Equip yourself with these strategic insights to transform your payroll accounting process into a model of efficiency and accuracy with our online payroll and accounting course. We will discuss debits, credits, liabilities, and assets. Payroll professionals play a pivotal role in ensuring that employees are paid accurately and on time while also maintaining compliance with relevant regulations and laws. To. Prepare for certification & gain foundational skills with our payroll course online where you can learn about deductions, payments, and payroll accounting. Unlock the keys to payroll education with payo. Payroll accounting is how employers record, track and analyze their payroll transactions. Master the complex world of payroll with practical examples, legislation insights, and comprehensive problems. Equip yourself with these. Payroll professionals play a pivotal role in ensuring that employees are paid accurately and on time while also maintaining compliance with relevant regulations and laws. We start with a brief overview of payroll accounting. Equip yourself with these strategic insights to transform your payroll accounting process into a model of efficiency and accuracy with our online payroll and accounting course.. This bookkeeping course lays out the fundamentals of payroll accounting. Payroll accounting is how employers record, track and analyze their payroll transactions. Payroll accounting is the process of recording and tracking compensation data, including independent contractor and employee wages, tax withholdings, and benefit. Up to 10% cash back this course prepares the learner with the basic knowledge needed to administer. Master the complex world of payroll with practical examples, legislation insights, and comprehensive problems. At the end of a tax year, as part of payroll year end duties, payroll accounting provides the information needed to produce employees’ p60 forms. Equip yourself with these strategic insights to transform your payroll accounting process into a model of efficiency and accuracy with our online payroll and accounting course. Trainup.com currently lists virtual payroll courses and training in and nearby the chicago region from 2 of the industry's leading training providers, such as hrcertification.com, national. Identify the key federal payroll laws and regulations that govern. Up to 10% cash back this course prepares the learner with the basic knowledge needed to administer the accounting for payroll. Payroll accounting is how employers record, track and analyze their payroll transactions. This bookkeeping course lays out the fundamentals of payroll accounting. The payroll training center offers a variety of payroll seminars, webinars, and online payroll training courses, as well as the certified payroll administrator designation. We will discuss debits, credits, liabilities, and assets. We then walk through an example of recording journal entries for payroll transactions. To obtain a payroll certification, professionals must complete certification training, which typically culminates in an exam and covers a range of vital payroll topics. Prepare for certification & gain foundational skills with our payroll course online where you can learn about deductions, payments, and payroll accounting. We start with a brief overview of payroll accounting. The payroll specialist certificate prepares students to perform activities associated with human resources, payroll transactions, payroll tax compliance and filing of all quarterly. Payroll accounting is the process of recording and tracking compensation data, including independent contractor and employee wages, tax withholdings, and benefit.What Is the Best Course in Payroll? Educatory Times

ACCT 032 Payroll Accounting Simple Book Production

Payroll Accounting Course Khata Academy

Payroll Course Learn Payroll Processing FC Training

Cengage Learning

4 Xero Online Beginners to Advanced Payroll Training Course NatBooks

basicpayrollcourse

Sage 50 Accounting & Payroll Discover Training

Payroll Management Online Course Institute of Accountancy

Payroll Accounting

Unlock The Keys To Payroll Education With Payo.

Payroll Professionals Play A Pivotal Role In Ensuring That Employees Are Paid Accurately And On Time While Also Maintaining Compliance With Relevant Regulations And Laws.

We Go Over Basic Terminologies, Important Payroll Formulas And Data Entry Methods To Explain The Role And.

Explore Our Programs And Essential Resources To Streamline Your Payroll Processes.

Related Post: